Building on our Canadian launch last week, we’re excited to announce that Nuula has partnered with Merchant Growth to make loans from $5,000 to $500,000 available to Canadian small businesses right from within the app.

Thanks to David Gens and the whole team at Merchant Growth for making this possible.

Nuula’s Canadian product provides a wide array of tools to Canadian small businesses owners, right from the palms of their hands.

This includes the ability to track and predict cash flows (thanks to our automated banking integration), to stay on top of financial performance (thanks to out of the box integration with Quickbooks, Freshbooks, etc.), to monitor payments and eCommerce activity (via pre-built integration with Amazon, Stripe, Square, etc.) and to stay on top of customer sentiment across a range of social platforms (thanks to real-time monitoring of Facebook, Google, TrustPilot, Yelp, OpenTable, etc.).

All of this is complemented by a range of integrated financial products designed to serve the needs of both small businesses and the entrepreneurs who run them. These include an intelligent corporate card, integrated wealth management, and now the ability to unlock critical capital to fund growth. More is coming in the next few weeks, including personal, cyber and business insurance as we continue to broaden the suite.

Insights. Capital. Insurance. Wealth. All for small business. All in the palm of your hand. What’s not to love.

Stay tuned … as always … lots more to come!

#smallbusiness #fightingforsmall #capital #fintech #superapp #nuularising

5 partner launches in 4 weeks ... wow

It's been a busy 4 weeks here at Nuula!

Thanks to our 5 amazing launch partners Mulligan Funding, LLC Walnut Insurance Even Financial OneVest and Caary Capital.

Just wait for what we have in store for the next 4 ... #nuularising #fintech #fightingforsmall

Early stages of disruption are often chaotic, web3 is no exception

In this timely podcast, Kara Swisher interviews Chris Dixon, a general partner at Andreessen Horowitz, and arguably the lead crypto investor there. Chris and his team have directed billions into blockchain and Web3 investments of all kinds. He’s sticking to his guns, in my opinion, with good reason … but, as he was clear with his LPs up front … this was going to be a wild ride.

We have the same kind of LPs as we have in our main fund, and they have a 12-year-plus horizon. And we tell them, look … this is just a different thing. It’s going to be riskier. There’s going to be bad headlines. But I really believe in it. I’m going to devote my career to it, but you should opt in only if you want to.

Often, the more contentious is the investment thesis, the greater are the returns. Worth a listen.

A Smart Card for Canadian Small Business

Most small businesses have two key issues: (1) they need access to capital and (2) they don’t have a ton of “back-office” resources to help manage their day-day paperwork.

The bottom line is that small business owners need modern credit options that are affordable, accessible and offer cutting edge automation.

Thanks to our partnership with Caary Capital in Canada, Nuula is able to introduce a best-in-class corporate credit card that makes spending easier to manage and cuts out tedious expense management tasks that can weigh a small business down.

The Caary card is a flexible, no-fee corporate credit card backed by Mastercard®, featuring higher credit limits, unlimited 1.5% cash back, and the ability to provision virtual cards in seconds.

Caary also provides a modern approach to tracking and managing small business spending. Its features include, integration with accounting systems such as Quickbooks, receipt capture, spending controls and the ability to provision unlimited numbers of virtual or physical cards.

Starting today, small business owners can apply for and manage this powerful credit platform right within the Nuula app. Caary’s corporate credit card comes with no personal liability, no credit checks and no fees. Plus, accessing a card is easy, with fully digital sign-up, onboarding and same-day approvals, all within the Nuula app.

Integrating Caary’s corporate credit card into the Nuula app is just one of the ways we’re bringing small business owners in Canada the tools and capital they need to succeed.

Thanks to John MacKinlay and the whole team at Caary Capital for enabling Nuula to be one of the first to preview this exciting new product in the Canadian market.

Nuula: Small Business Insights. Metrics. Capital. Insurance. Wealth. All in one app. What's not to love?

As always … lots more to come … so stay tuned.

#businessowners #smallbusiness #fintech #credit #superapp #canada#nuularising

Nuula Launches in Canada

We are thrilled to announce that Nuula is now available in Canada.

As many of you know, Nuula’s super app delivers a range of critical features to help small business owners stay on top of what matters. It helps them track their cashflow in real time and alerts them to cash shortfalls before they happen. It helps them monitor critical financial and commercial metrics in a simple and easy to digest manner, and it makes it easy for them to track customer sentiment, including online ratings and reviews.

Complementing this, the app provides an integrated suite of financial products designed to serve both the needs of the business and the business owner. These include personal and business insurance, loans designed for businesses at different ages and stages, and smart credit cards which help automate and alleviate back-office overhead. Rounding this out is an integrated wealth management offering that helps entrepreneurs grow and diversify their wealth.

Nuula is based in Toronto, so we are particularly excited to bring this unique and innovative financial service offering to our home market.

This is truly a first for Canadian small business.

As you will also know from my many posts over the past few weeks, Nuula is designed to seamlessly integrate best in breed products from a carefully curated ecosystem of partners. The company's Canadian launch integrates two exciting new embedded financial products from Canadian companies, Caary Capital and OneVest

Thanks to John MacKinlay, Amar Ahluwalia and their teams for being such great partners. We're looking forward to building something great together.

Here’s what our two Canadian launch partners have to say …

“Small businesses are at a disadvantage when it comes to financial service offerings and access to capital. That’s why innovative fintechs like Nuula are so important, Channel partnerships have been a key focus of our market entrance and we are pleased to report that Caary’s corporate credit card will now be offered in the Nuula app to Canadian customers. It’s great to team up with another Canadian fintech that is equally dedicated to serving Canada’s small business community.” - John MacKinlay, CEO at Caary Capital

“OneVest is proud to deliver a modern wealth management service through the Nuula app,Entrepreneurs deserve better, more convenient options to make their capital work for them. OneVest, embedded into the Nuula app, will provide Canadian small business owners with an easier way to invest and grow their wealth”. - Amar Ahluwalia, CEO at OneVest.

As always ... so much more to come ... stay tuned.

#wealthmanagement #creditcard #capital #businessowners#smallbusiness #fintech #superapp #nuularising #canada

Nuula now helps small business owners diversify and grow their wealth

Today we are launching a fantastic partnership with the team at OneVest to deliver wealth management for Canadian entrepreneurs right inside the Nuula app.

Small business owners typically focus everything on their businesses, and often the wealth of their families is inextricably tied to the success of those businesses. Complicating this is that they are often solely responsible for their own wealth management. From retirement, to investing, to planning for major life events, most small business owners do not have the benefit of employer programs. In fact, according to Forbes, one third of small business owners do not have a retirement savings plan at all.

Nuula is launching a new wealth management feature to give small business owners a way to help diversify their wealth, and plan for the critical milestones in their lives like retirement, buying a home, or expanding their family.

Powered by the OneVest platform, our customers will now be able to invest like the 1%, unlocking access to a fully digital, actively managed, goals-based investment experience, personalized just to them. With this feature, Nuula now provides entrepreneurs with the tools to help grow their net worth both inside and outside their business, enabling them to fund one or more investment accounts, set goals, and track their progress. The solution is fully integrated within the app, so our customers can manage their business and their investments in one place.

It’s been a pleasure working with Amar Ahluwalia and the team at OneVest over the past few months, as we have integrated the capability of this fantastic platform into Nuula. The product will initially be available in Canada, with expansion to the US market expected later in the year.

Personal wealth management for entrepreneurs, in the palms of their hands. What’s not to love.

As always, stay tuned … lots more to come.

#investing #wealthmanagement #smallbusiness #entrepreneurship#nuularising

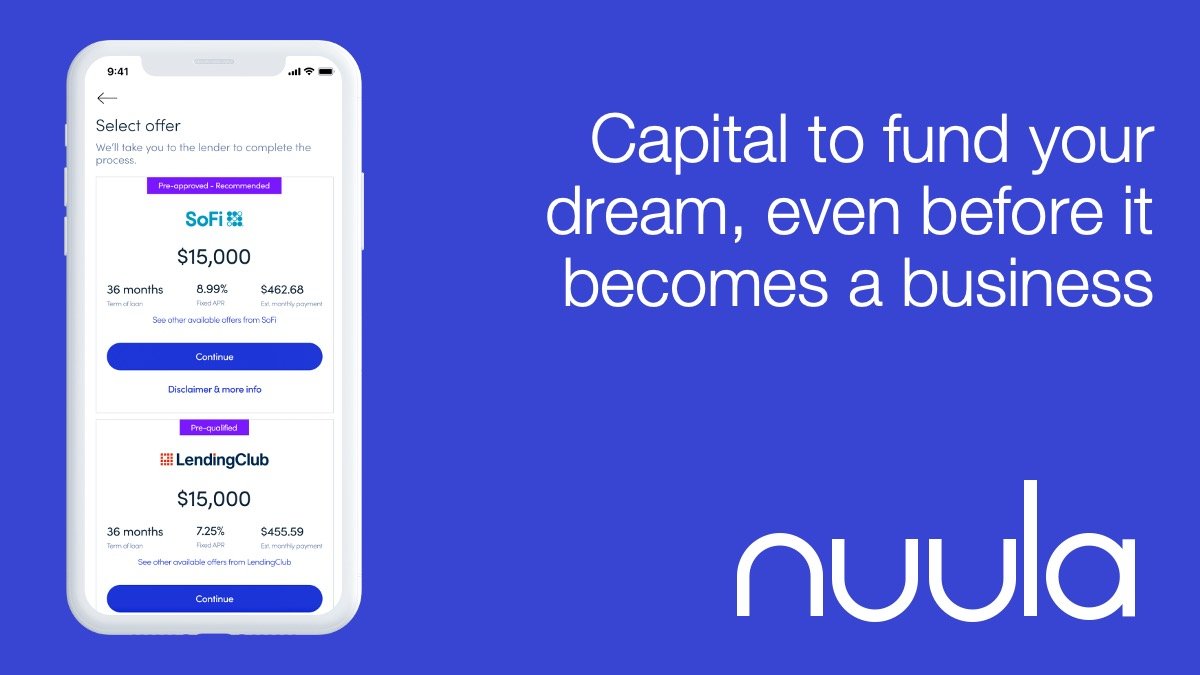

Nuula launches funding for early stage businesses

One of the hardest things for a small business is getting early stage capital. Most lenders, and I know this first hand, won’t even look at you until you have been in business over a year, but more likely two.

So, how do you raise money for a new business in its early stages? Typically with personal loans, or cash from fiends and family.

At Nuula, we felt we needed to help solve this problem, so we have partnered with Even Financial to enable our customers to unlock access to loans from over 30 lenders. Right from within the app.

Now, you’ll be able to fund that idea, even in the early stages, often same day.

Just another way we are working to help entrepreneurs realize their dreams.

Stay tuned … as always … lots more to come.

#entrepreneurs #smallbusiness #funding #nuularising

Addressing the challenges of latency in space based networks with blockchain technology

We are still at the early days of identifying all the use cases around blockchain technologies, but an announcement from Davos this week caught my eye.

Lockheed Martin and the Filecoin Foundation have collaborated to demonstrate a blockchain network in space that helps address the latency issues that would typically be found in Earth-Space networks.

Joe Landon, vice president of advanced programs development at Lockheed Martin Space, said the goal of the project is to develop a mission to demonstrate the Interplanetary File System, or IPFS, in space.

IPFS is an open-source network that stores information that can be shared by users. The Filecoin Foundation is an independent organization that facilitates governance of the Filecoin network — a blockchain-based cryptocurrency and digital payment system that builds on top of the IPFS.

Landon said critical infrastructure is needed in space for accessing and sharing data. “Filecoin is a decentralized storage network built on top of IPFS,” he said. “The Filecoin network is powered by a blockchain-based protocol, which is used to incentivize independent storage providers to contribute storage and offer competitive deals to store customer data.”

“We need to develop the technology to support a long-term presence in space without having to rely entirely on Earth-based communications and data storage,” he said.

Marta Belcher, president and chair of the Filecoin Foundation, said today’s centralized internet model “just doesn’t work in space.”

“Every time you click, that data has to be retrieved from a particular server in a particular place,” she said. “That means that if you’re on the moon, there’s going to be a multi second delay while that data travels from Earth, but with IPFS data isn’t retrieved by where it is, but rather by what it is, so it can be retrieved from whatever’s closest to you, eliminating that delay.”

Over the next several months, Lockheed Martin and Filecoin will work to identify a spacecraft platform to host an IPFS payload that will relay data to and from Earth,and other spacecraft.

“We are starting out with an exploration phase that will include scoping the technical work required and identifying the right demonstration mission,” said Belcher. “Once we have identified the appropriate mission or missions, we’ll have a longer-term timeline.”

The initial payload demonstration is being planned for low Earth orbit.

IPFS allows users to back up files and websites by hosting them across numerous nodes. Landon said this project aims to bring the benefits of decentralized storage systems to space. “Ultimately, by minimizing the number of times that data has to be transmitted to Earth and return to space, IPFS’s decentralized storage model will enable more efficient data transfer and communication in space,” he said.

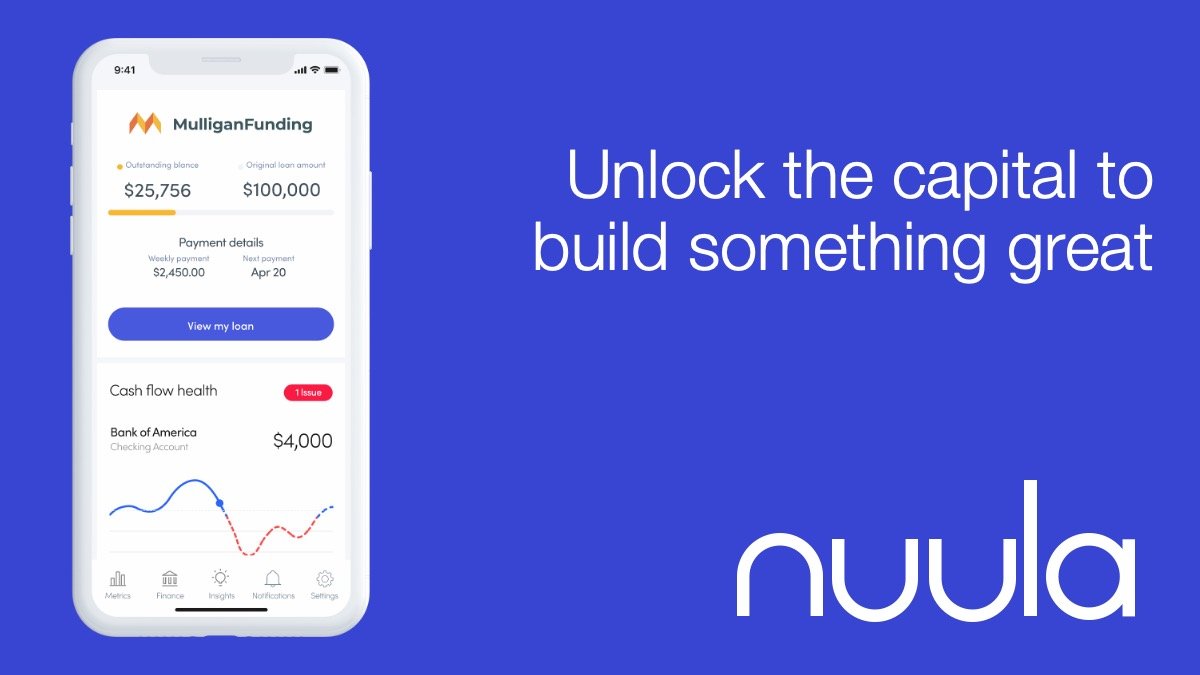

Nuula makes small business loans of up to $2MM available in the palm of your hand

As I have been signalling, there would be more to come from Nuula as we roll out a suite of integrated financial products that serve both the needs of small businesses and the entrepreneurs who run them.

Easier this week, we announced a partnership with Walnut Insurance to provide a wellness package for entrepreneurs.

Today I am thrilled to let you know that we have partnered with Mulligan Funding, LLC to integrate their term loan product deeply into our app, and in so doing, help entrepreneurs power their vision.

Starting today, Nuula customers will be able to apply for up to $2MM in business funding directly from the app. They will also be able to monitor and manage their loan 24/7/365 right from within Nuula.

Capital is the lifeblood of small businesses, and it’s always been at the heart of our mission at Nuula.

It’s been a pleasure getting to know David Leibowitz and the team at Mulligan over the past couple of years, and I’m excited to launch this product with them.

Access to up to $2MM in capital from the palm of your hands ... what's not to love.

As always, stay tuned … there’s lots more to come!

#smallbusiness #fintech #capital #smallbusinessfunding #funding #nuularising

Understanding how profound web3 actually is ...

Despite all of the hype and hysteria surrounding Crypto, Blockchain technology and DeFi, Web3 is both in its infancy, and here to stay.

a16z has been an early and aggressive investor in this space, and their views on this emerging ecosystem are always worth reading. Their 2022 State of Crypto Report is a helpful primer and a timely and pragmatic update on the sector.

As with all early technologies, there will be winners and losers, fortunes made and lost, legacy industries disrupted or transformed … and there will certainly be a lot of entropy … but few technologies have come along in a very long time that have this sort of disruptive potential. Ignore this space at your peril.

Serving the needs of both the Business and the Entrepreneur

For a small business owner or entrepreneur, work and life are inextricably linked.

I know this first hand, having launched two early stage startups, and having led fast growing companies of various sizes for over 20 years.

I am therefore thrilled to let you know that starting today, Nuula is launching a new approach to small business financial services by focusing not only on the needs of the business, but also on the needs of the small business owner.

In partnership with Walnut Insurance, Nuula’s new health and wellness feature offers access to meditation, sleep guides, and mental focus programs through Headspace Plus in addition to online fitness programs through ClassPassDigital. The programs are paired with $10k-$50k of Life Insurance to help give small business owners additional peace of mind. All of this is available for as little as $9/month, and can be activated in less than 2 minutes right from within the Nuula App.

The new offering complements Nuula’s existing portfolio of free small business tools, including financial & sales performance tracking, cash-flow forecasting, personal and business credit monitoring, and the ability to stay on top of customer ratings and reviews … all delivered 7/24/365 in a simple, easy to digest format, right to the palms of your hands.

Nuula’s focus on the entrepreneur’s well-being, in addition to business performance, was driven by insights into how personal stress is affecting small business owners, especially with the pressures of the COVID-19 pandemic.

A recent Capital One survey found that 45% of small business owners report that running a business during the pandemic has had a negative impact on their mental well-being, and 42% say they are currently experiencing burnout or have experienced it within the past month.

It’s just another way we’re thinking differently about serving the needs of small businesses, and the entrepreneurs who power them.

Stay tuned … lots more is coming!

#health #businessowners #fintechinnovation #wellness #smallbusiness

Our notion of "the office" will likely never be the same

There has been a lot of discussion recently about how "return to the office" should be handled. Some companies are "back", some are mandating 2-3 days a week in the office, others have re-configured to be primarily remote, perhaps in perpetuity.

At Nuula, we have been thinking deeply about this, particularly in the context of what the best answer should be for our company and for all of our stakeholders.

As a technology and data science company based in Toronto, we are in a war for talent. And as a venture backed business, with a ton of world beating ambition, we're also driven to run farther and faster than our peers. All of this is built on hiring the best and the brightest, and finding the most opportune way for them to leverage their skills and each other.

As a CEO, I believe in building cohesive, dynamic, ambitious teams that are comfortable challenging pre-conceived notions. But that means, as a leader, I must also challenge my own pre-conceptions.

Historically, I have always enjoyed face-face interaction. And those who know me, know that I have always led by "walking around" ... even when my teams were spread across the world (yes, I have the air miles to prove it). But, something fundamental has shifted over the past few years, and it is worth understanding.

A combination of COVID, technology and time has challenged the pre-conceived notion that effective collaboration requires that we work together face-face, primarily in open plan offices, and that we do so most of the time. In fact, for many people, the relief of not having to commute an hour or more each day, and not sit in sometimes chaotic and noisy open plan environments, has changed their expectations of both productivity and work-life balance (or as a Type A myself, what I like to think of as work-life integration). Once we worked through the kinks, many of us actually saw increases in both productivity and employee satisfaction as we adopted to hybrid work.

As leaders we ignore this cultural shift at our peril ... and at the peril of our businesses.

At Nuula, we work hard to remain in touch with the sentiment, needs and wants of our Team members, polling them regularly on a number of issues on which we want their feedback. We recently updated our "return to office" sentiment index, and the results were fascinating.

Our most recent poll (see above) has indicated a fundamental shift in sentiment away from the office as our default mode of operation. Our team does not seem to be pining for the "good old days" of in office interaction, nor do they want us to impose some sort of arbitrary 1-2 day per week rotating office use. They want to live and work more on their terms.

60% of them are happy coming in for intentional "collaboration" or having the office as a place to work when they want to or need to ... but a surprising 40% are now seeking a more fundamental shift to a primary WFH mode ... in particular if that affords them the ability to live where they want.

We engage in this communication with our teammates, because we are striving to ensue that Nuula is the place where the best and the brightest want to come to work. We hold ourselves accountable quantitatively by tracking a satisfaction/sentiment index and an eNPS score, but we also seek qualitative feedback on a regular basis to try and understand what we can do better.

We are going to be taking this feedback seriously, and working even harder to lean into providing the flexibility sought by our teammates, re-imagining our concept of what it means to work at Nuula, how we work together better regardless of where we are, and the fundamental meaning of what our office is, and how we use it.

I'll try to update you on our progress ...

Work/Life Integration and the 4-day Work Week

We recently started to experiment at Nuula with an optional 4-day work week.

We started by asking ourselves ... what if people didn't have to commute an hour a day ... how could we re-purpose that time to start with, and what might they be able to accomplish ... we also figured that a zoom/pandemic fatigue was a real issue, and we wanted to give people recharge time.

We hoped that when people know they had less time for work, they would become more intentional. They might also happier. They might also be more creative.

We realized that we needed to be deliberate and thoughtful about this as an organization ... we needed to force ourselves to reduce the typical overhead that seeps into traditional weeks. Cut the fat of unnecessary meetings …

The test started with our Technology team, and as is typical with all things Nuula, we set up a way to review outcomes in a disciplined way, through a blend of qualitative and quantitative lenses.

At this stage, about 80% of our Tech team takes advantage of the program, and while we're not yet ready to make a permanent decision one way or the other, initial feedback (qualitative) and productivity scores (quantitative) are both very encouraging so far. A sneak preview on the quant side is that our story point output is as good, if not better across 4 days as opposed to 5.

I'll update you more on our learnings over the next few weeks, but I think this option is going to be here to stay. We are certainly seeing happier and more productive team members.

In the mean time, the following article outlines some issues/considerations/approaches. Worth a read.

This was a nice surprise

We were happy to find out this week that #Nuula was selected as a finalist for the Small & Medium Business Sized Lender of the Year and that I’d also been selected as a finalist for the Executive of the Year as part of the 2022 Leaders in Lending Awards presented by BMO Financial Group.

Thanks to the Canadian Lenders Association for the nominations and congratulations to all of the finalists!

Disruptive Innovation

A friend of mine who is a former Goldman exec, recently articulated something I too have been feeling for some time; namely that we are at a particularly exiting period of disruptive innovation … with implications both sectoral, and cross-sectoral.

Accelerating advances in Genomics, Energy (both generation and storage), Blockchain (and decentralized finance - or DEFI), Web3 (and the Metaverse), Robotics/Autonomous driving, 3D printing, AI, etc. are creating an opportunity for seismic shifts in healthcare, supply chains, transportation, finance, entertainment, etc.

As with all periods of disruptive innovation, there will be winners and losers, in both new and legacy industries. And with any early stage of disruptive innovation it won’t exactly be clear who the winners and losers will be.

Ignore this at your peril though … there are fundamental implications for many companies and many industries … and if you are a business eater (in any business) you need to understand them.

Although it has recently become the family of funds that people seem to poking fun at (due to a temporal downfall in value as investors have shifted to “risk off” assets), I have a huge amount of respect for the mission, vision and approach taken by the team at ARK Invest. I will leave it up to you to make your own investing decisions, but one thing I would recommend is that you look at their research, it’s both accessible and informative.

Each year, they publish a Big Ideas presentation. It’s available in PDF from their website, but below is their annual Big Ideas Summit. It’s a thorough look into a range of emerging technologies and their inherent disruptive potential.

Who knows how much of this will come to light, and in what way. And who knows which individual investments will be winners and which will be losers. But, if you are not conversant in some of the these areas, I suggest you become so.

January Progress Update

This month, the challenge for the marketing team was to continue the account registration momentum with a 33% reduction in marketing spend Month on Month. Thrilled to say, not only did they do it, but registration for the line of credit waitlist soared.

This month was all about improvements in targeting … the CPI remained relatively constant, but the conversion rate rose, and as a result CAC fell.

Next up … moving deeper into the retention/engagement and monetization stack …now that we have the data we can start to identify and target customers with the highest propensity to activate tools and/or successfully apply for one of our credit products.

Telling the Story of Nuula

Thrilled to show off the work our team has done on a 60 second spot for Nuula. Particularly remarkable that it is all stock video and was extremely inexpensive to produce.

Employee Wellbeing

We are human powered businesses.

As leaders, we are constantly asking ourselves if we are creating a workplace that the best and the brightest would want to work for, and fostering an environment in which they can thrive.

At Nuula, we work hard to have a clear and exciting mission and to offer challenging and stimulating roles for our teammates. We try to hire well and train well. We provide opportunities for growth. We celebrate diversity. We’re accountable to each other, and we’re open, honest and transparent.

These are table stakes …

We also understand that we hire whole humans … with different sets of dreams, fears, obligations, strengths, weaknesses … and in trying to foster an environment in which our team members can thrive, we need to take this into account. We try hard to look at the more holistic needs of our teammates … and in doing so, we acknowledge that they have lives outside of work.

One of the key elements of this strategy (and there are others) is that we provide structured and unstructured time off in which to rest, recharge, and inspire creativity. And while we work incredibly hard, we strive to make it easier for our employees to have a healthy work-life balance. We’re proud to offer our employees the flexibility to take care of themselves and their families.

This stuff matters. A lot.

About 4-5 times a year, we give the team the day to explore their creative side, to learn to discover, to mentally refresh … and we then encourage them to share what they have done. We call these Nuula You Days …

Here’s a video we put together to get our team motivated for our upcoming You Day.

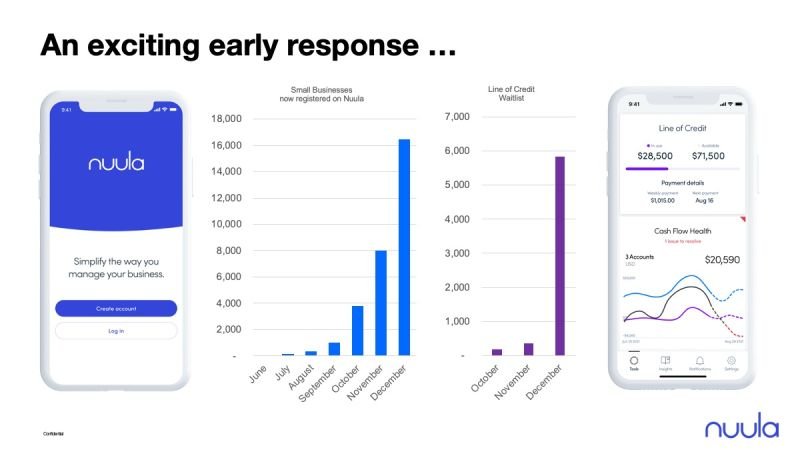

December Milestone

As I was making last month's post about the progress we had seen with Nuula, I couldn't help but wonder if we would be able to keep up the rapid rate of (exponential) growth.

Well, we did ... by the end of December, the number of small businesses who had registered on Nuula had grown to over 16,000 and the Line of Credit waitlist had grown to just under 6,000. Encouragingly, CAC had fallen to below $30.

I think our thesis is playing out ... clearly a new generation of small business owners is hungry for a new generation of financial services.

In the coming weeks, complementing our "cash in the cloud" line of credit, we will be announcing larger longer term loans, a modern digital credit card, and a suite of insurance offerings ... all brought to the platform by a carefully curated ecosystem of partners.

50,000 Download Milestone

Nuula just passed 50,000 downloads on Google Play ... less than 6 months in after our quiet test and learn start ... not a bad way to end a week!