It's so encouraging to see the excitement that Nuula is generating amongst US small businesses.

Once again, we have doubled lifetime registrations month on month. Furthermore, the wait list for our new "cash in the cloud" line of credit has started to surge in the few weeks that it has been open. Yes, the chart is way out of date as of this morning ... the waitlist will hit 500 today, and November 30th was only three days ago.

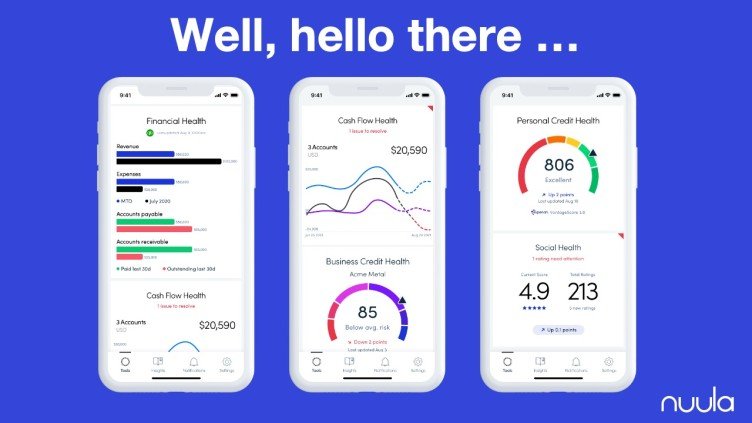

Nuula's Financial Health Tool

So excited to be launching Nuula's Financial Health tool this morning.

Most small business owners want to keep up-to-date on the overall health of their business daily, but rarely have the time to do this. By coupling a small business's accounting data with Nuula's existing business tools and insights, including cash flow tracking, personal & business credit monitoring, in addition to customer reviews and ratings, we've made that even easier. Anytime and anywhere. In the palm of their hand.

Thanks to the team at Codat for helping to power this new tool, and to the amazing tech team at Nuula for such an elegant solution.

So much more to come ... stay tuned ...

October MILESTONE

As a CEO, it's always encouraging to see customer demand soar for your product, in particular when that demand is evidenced by exponential growth in registrations. For Nuula, October saw 3.7X more small businesses registered on the platform than all prior months combined. Capping 4 successive months of accelerating growth.

To complement the Cashflow Forecasting, Credit Monitoring and Customer Sentiment tracking that we already offer small business owners to help them stay on top of what matters, our revolutionary "Cash in the Cloud" line of credit has now launched into private beta. If you want to get on the waitlist, please let me know.

Stay tuned ...

Exciting News: Today Nuula Was Born

I joined BFS Capital two and a half years ago because I saw an opportunity for significant innovation in small business financial services.

After seven years working in online consumer finance, managing businesses across North America, Europe, South Africa, and South America, I had first-hand experience bringing industry-leading fintech solutions to market. When I looked at what was happening worldwide in consumer finance, compared to the types of legacy, laggard experiences small business owners were still wrestling with, it was clear that there was a significant innovation gap. On top of this, a new generation of small business owners was emerging, demanding the anytime, anywhere, on their terms, mobile first experiences they were now accustomed to in the rest of their digital lives. It was clear we were reaching an inevitable point of inflection in small business financial services.

The investors behind BFS agreed, and together we committed to transforming a company that had deep roots in small business lending, and a deep understanding small businesses in its DNA, into one that was equipped to lead innovation in small business financial services. Our approach was to start by leveraging our two decades of data and experience, from tens of thousands of customers across 400 industries. Based on these unique insights, we would build a fintech startup that would provide small businesses with innovative financial solutions that not only met their emerging digital expectations, but helped them drive great business outcomes.

We quickly assembled a leadership team whose experience spanned global financial services, innovative challenger banks, mobile app design, creative and brand development, customer experience innovation, and digital transformation. But most importantly, we sought a team capable of rapidly developing and executing an ambitious strategy to emerge as a leader in small business financial services.

We spent time with the next generation of small business owners understanding their pain points, their motivations, and their passions. We sought inspiration, worldwide, from the best mobile and digital experiences we could find. We crafted a vision for a company that provided not only innovative financial solutions, but employed a more holistic approach, delivering content, tools, and financial products, purpose-built to serve small business owners’ daily critical needs.

Our next job was transforming a two-decade old “mechanical turk” of business into a lean, digital, mobile first fintech – all in the middle of a pandemic. We made the tough decision to significantly reduce our legacy team, and immediately set about acquiring the skillsets we would need to realize our vision.

We established a digital headquarters in Toronto, and focused on hiring world-class talent in data, machine learning, technology, and digital marketing. We transformed internal workflows completely, in order to support a remote and distributed workforce across the US, UK, Canada, and South America. Most importantly, we shifted our philosophy from solely selling loans acquired primarily from brokers, to providing a more holistic, customer-centric mobile app that entrepreneurs would find useful each and every day. This app-centric model would not only radically improve our customer acquisition, engagement, retention, and monetization efforts (thereby reducing acquisition costs and increasing customer lifetime value) but it would be the foundation for us to deliver a significant increase in enterprise value.

The reimagined future of BFS starts now, and today I’m proud to announce that BFS Capital has become Nuula. This brand change represents the manifestation of the shared vision and effort from our entire global team across the past 18 months.

Nuula is a mobile application that gives small business owners instant access to critical business metrics anytime, anywhere. It allows real-time monitoring of cash flow, personal and business credit activity, and social ratings and reviews. Small business owners know immediately if there’s an issue with their cash, credit, or reputation that requires action.

But this is just the beginning. Our goal is to empower small business owners by unlocking access to the smartest and most innovative financial solutions available. Some delivered by our team, others delivered by a carefully curated set of partners. All delivered to the palms of their hands, anytime, anywhere, within a seamless user experience.

So stay tuned. In the coming weeks and months, we will launch a suite of next generation financial products, including a revolutionary line of credit that will enable small businesses to access the capital they need to thrive.

With regards to our legacy business, our team will continue to support our existing customers and partners as we transition all our services to Nuula. Our existing customers will be the first to be offered a chance to experience Nuula. And over the next few weeks, our existing working capital customers will be able to unlock additional capital from the first of our Nuula ecosystem partners, with exciting incentives and in a way that is as seamless as possible. We expect to make that announcement soon.

I want to thank all of the team, our board, and investors, in addition to our partners and customers who have gone on this journey so far. And we look forward to breaking new ground together with Nuula. For small businesses, we believe this changes everything.

Mark Ruddock

CEO, Nuula

Keynote at Data Analytics & the Future of Lending

Here are some rough insights on the fast growing role of data science in the future of small business lending.

Thoughts On Leading In Times Of Crisis

I recently gave an interview for the Edison Partners Lighthouse Series, sharing some thoughts on what it’s like to lead in a time of crisis. The transcript is below.

Hope my fellow CEOs find it useful. I’d certainly love to hear your thoughts and insights.

How are you feeling at the moment?

I think entrepreneurs are a strange breed. My wife jokingly describes me as “pathologically optimistic, and pathologically forward looking” (she’s a therapist, so I am often finding myself diagnosed).

It may be true. As entrepreneurial CEOs, we do seem to be focused on opportunity, regardless of the conditions of the moment.

That doesn’t mean I am not a realist. I have been concerned about COVID-19 for some time, and have been trying to understand the potential implications for our nations, our economies, and the business I am charged with running.

A number of weeks ago I told my adult boys, who at the time were trying to get their heads wrapped around the extent and implications of the crisis, that the problem with exponentially driven issues is that it all seems OK until it is horribly not. I should have shorted the market.

So what does this all mean? For me, I’m now as increasingly focused on opportunities that may exist after this crisis, as I am on the tactical day-day implications of survival in the interim. We’re positioning the firm to thrive on the other side.

As I have been thinking about where we find ourselves, I keep getting pulled back to two quotes:

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way ...” Charles Dickens

Or my personal favorite:

“Certainty of death. Small chance of success. What are we waiting for?” Gimli

Chaos and adversity breed opportunity, and the strong survive.

Most of us as leaders have stared into the abyss multiple times as we have built companies (frankly most great companies have stared into the abyss from time to time) … and each time, I’m sure for moments, the challenge has seemed insurmountable, but at the end of the day, we have just worked the problem. That’s what we need to do now.

Working the problem needs some sort of structure though. And structure comes best from a clear sense of direction. Each tactical decision we make as CEOs needs to be founded in an overall strategic arc. If you don’t have that strategic arc, everything becomes more difficult. It’s just day-day whack-a-mole.

Times of disruption are times of opportunity. Many great businesses have been born in times of crisis. And while this is an unprecedented crisis, with horrible implications to people’s health, their livelihoods, the overall macroeconomic picture, our personal portfolios, our investors’ portfolios, our businesses, our teams, our customers, etc. we, as CEOs, need to put all of that aside each day and focus on the ball.

How do we “survive to thrive”.

Has the overall investment thesis of this business changed?

If so, what is the new opportunity? And what does that imply about our strategy and the resources we need to get there.

Based on all of this, what do we need to today, tomorrow, next week to enable us to prosecute that opportunity.

So, how am I feeling? Well, I am just working the problem, and washing my hands like a mad man, while being focused on and tentatively excited about the future.

How do you prepare your week when it is hard to predict even what the next day will bring?

As a CEO you are always running two tracks in your mind … the critical near term decisions/actions you have to focus the team on each day … and the longer strategy arc that you must never lose sight of (lest you can’t qualify/prioritize and/or you can’t make the day-day decisions without critical context) … sometimes it is 20/80 … sometimes 80/20 … sometimes somewhere in between … but it should never be 100/0 or 0/100 … at least for more than a few minutes. I learned that a long time ago …

I guess my personal philosophy is:

Everything is easier with some sort of goal.

You can really never prepare for every eventuality. But do try to game out a few.

Things will always change, so be prepared to be flexible.

But never ever lose sight of the goal. Everything you do as a leader has to play some part in getting you and the team to where you are trying to go.

To me, being a CEO is about being more of a coach of a sports team, than being the best player on the ice. Don’t get me wrong, sometimes you have to jump on the ice, but if all you are doing is playing the game and focusing on the puck, it’s likely to end badly for the team.

What does that mean? Your job is to ensure there is always a clear game plan for the team – both near term tactical and longer term strategic. As a result, as a leader you need to be better prepared for what the week might bring than your team. So think it through.

I guess my day starts before I wake up (not always a good thing if my brain turns on at 3:00 in the morning). I think our subconscious works the problem while we sleep. I often find myself waking up already in motion … with a sense of the priorities, sometimes without consciously remembering thinking about it.

What do we need to do this week to remain well positioned to realize the opportunity. Rinse repeat.

Do you have a priority checklist? If so, can you share a couple of things on it?

We have a program in place right now called “survive to thrive” … and at the moment, that is quite focused on the “survive” part of the equation.

Let me take slightly broader look at 6 things I am trying to stay focused on right now:

#1 Cash. Cash is king, and while short term cash is critical, in a crisis, longer term cash is almost as critical. Third party capital is a privilege, not a right. Don’t expect it to be there.

#2 Clarity. You’d be surprised what a smart team of people, ruthlessly aligned behind a common goal, can do. Am I, as a leader, and are we, as a team, absolutely clear on what our focus needs to be today, tomorrow, and (subject to entropy) next week? Do we understand, and are we all aligned behind pursuing our north star?

#3 Communication. Constant communication with your leadership team, employees, investors, partners, peers, customers during times like this is critical. Information equals advantage – use it. Communication breeds trust and community. In times of chaos, real time communication between you and your team is critical. Even now in a highly distributed, working from home environment, I am on a constant chat/teams/zoom with our team. I endeavor to respond as quickly as I can to any question. And we are doing weekly town halls for the time being.

#4 Concurrency. You cannot be in the middle of every decision as a CEO. Your management team is a force multiplier. Don’t be the bottleneck. Clarity of purpose, constant alignment and ambient communication, makes that possible. Work the problem in parallel. Leverage the strengths/characteristics of your team. But that doesn’t mean that you decide everything in a committee. We’ll get back to that in item 6.

#5 Candor. Teams built on trust outperform ones that do not. Trust comes from transparency and candor. Don’t be afraid to be authentic. Don’t be afraid to deliver tough news. Context matter to people when they are being asked to operate outside of their comfort zone. Context matters when you have to let people go.

# 6 Courage. In times of crisis, CEOs often need to make tough decisions, often very quickly. Companies are not democracies. Consensus won’t always be achieved. Try to make decisions with the best information at your disposal, leverage the insights from your leadership team/peers/board/etc, but don’t be afraid of making them, even when there is imperfect information. Sure, try to be right, try to ensure that each decision is tested against the strategy arc of the business, but don’t be afraid to err on the side of speed and clarity over being right every time. So just make the freaking decision, and move on.

Who do you seek out for advice on your business (excluding investors)?

At the moment, given the crisis small businesses are facing, and the inherent risk to all small business lenders, I am in constant communication with our peers. As Frenemies, we are all in this together. And I find their insights invaluable.

I am an avid consumer of content. And there is a lot of ambient information out there that can provide not only the data on which to make decisions, but which allow you to understand how others are thinking about the problem. Listen to smart people, even the odd pithy quote.

“Should you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted to patching leaks.” Warren Buffet.

A good board is an asset, and having experienced, independent board members whom you can run things by as a CEO is important. Use them.

Right now, I am also seeking input from the funds backing our loan books. They have a unique view on the market, and often a valuable source of what is happening across the industry as they deal with many counter-parties.

Though I am not a big fan of “thinking out loud” as a CEO, at least in front of the broader team, never underestimate the value of your management team in providing insightful advice and input. These guys have cross functional expertise, different viewpoints/innate characteristics, and varied experience pools that are a valuable source of insight and inspiration. As a good leader you realize that it’s not your job to have all the answers, it’s your job to elicit the right answers. So seek other’s input. It doesn’t make you look weak. Most of the time, solutions to problems solved and worked collectively, tend to be far stronger.

How are you keeping yourself sustained and finding moments of relaxation?

There is a bit of a silver lining in all of this. Now that I am grounded in Toronto, I finally get to be with my wife and kids for a sustained period of time. We have a lot of fun together.

Once I am off my 14 day post US travel quarantine, I plan to get out on my bike and ride in the deserted ravine near our house. Exercise matters.

Sleep also matters. As a CEO, you are a net source of energy, good humor, and inspiration for your team. Being tired and run-down doesn’t help anyone. The problems always seem so much more solvable when you are well rested. Use that time.

Escape matters too. If I can find the time over the next few weeks, I would love to get back to making some music. There is something about that process which is all consuming … it takes you completely out of your regular headspace, and I think, inspires creativity. Whatever your escape is it. Use it.

Any last thoughts?

Not that I have read the novel, but I stumbled across a quote by Judith McNaught from a book called Paradise the other day that I think sums up my current mindset.

“You can’t outwit fate by standing on the sidelines placing little side bets about the outcome of life… if you don’t play you can’t win.” Judith McNaught

So go play …

Canadian Lenders Summit Keynote

Had the pleasure of presenting the keynote at the Canadian Lenders Summit in late 2018, just before joining BFS Capital. Looking forward to seeing everyone again at the Data Science Summit in Toronto on February 27th 2020.

Lend Academy Podcast

Was wonderful chatting with Peter Renton of LendIt as a guest on his PodCast. Peter is a really interesting guy, with some superb insights about the FinTech industry.

You can subscribe to the Lend Academy Podcast via iTunes or Stitcher. To listen to this podcast episode there is an audio player directly below or you can download the MP3 file here.

Brad Feld is always worth reading ...

As usual, a great post from Brad Feld, on the recently published "Bad Blood: Secrets and Lies in a Silicon Valley Startup"

“The best founders that I’ve worked with combine a mix of their aspirational goals with a real grounding in the current reality of where the business is. They know that their aspirational goals are goals – not current reality. And they know that there isn’t a straight line to the goals. If they use their reality distortion field as a charismatic founder, it’s to motivate their team to build something, not deceive investors or customers into believing it has been built.

Because, after all, in the end, we are all vulnerable to facts.”

How true ...

Mary Meeker 2018

Mary Meeker's must watch Internet Trends Report. I feel so strongly about this that the report from last year is actually the last post I made on the blog, roughly one year ago. Not very good ... it's been a busy year clearly ...

Mary Meeker's Annual Must Watch Presentation

Each year I try to share Mary Meeker's Internet Trends Report, as I consider it a must watch. This year is no exception.

Another Road Trip Means More Music

The streets in Moscow were packed this weekend with the city's annual celebrations. So I had a chance to wander around, enjoying this beautiful place.

I have been discovering that Moscow does have a vibrant Electronic Music scene, and I managed to discover a number of great music stores in the city, eventually ending up in one and picking up a small traveling production keyboard (an AKAI) to complement my CME xkey.

Doesn't quite measure up to the rig at home, but it does fit in a backpack, and I did manage to get some much needed time in Maschine.

Fintech Industry Synopsis

The following is a useful review of current FinTech industry trends and insights, in addition to an overview of recent activities by both Fortune 500 companies and startups' in the space.

The report covers banking tech (security, crm, analytics), payments (pos, money transfer, commerce), cyber currency (blockchain, bitcoin, wallets, cryptocurrency exchanges), business finance (lending, crowdfunding), personal finance (lending, wealth management, mortgage, credit), and alternative cores (banking, insurance).

Recommended Watching This Weekend

The annual Code conference is a treasure trove of insights and information from the A-LIst of the tech world, and this year doesn't disappoint. If you have time, you should really try to review most of the content, but here are four presentations/interviews worth watching this weekend.

The first is Mary Meeker's annual "state of the internet" update ... a fast paced review of key trends ... and it is required watching every year, in my opinion.

The second, Walt's interview with Jeff Bezos at Amazon.com, is filled with interesting perspectives, and data points. Amazon will continue to be a powerful force in retail, infrastructure, logistics and AI for years to come, and Jeff's vision is worth understanding.

The third is Sundar Pichai, CEO Google who covers where Google is heading with AI, how they are trying to make it easier and more helpful to consumers, and some of the ways in which they are thinking about complex issues such as privacy.

The final is Elon Musk's interview with Kara and Walt. Elon is one of the key influencers of our time, and is involved in a number of groundbreaking investments on earth and in space. Worth understanding this fascinating individual, and his vision and insights. He also delivers a simple overview of what it takes to really launch a rocket and then recover it .. appealing to your inner geek.

Accountability in advertising

Fighting words from Gabe Laydon, CEO of Machine Zone, one of the largest buyers of advertising in the world. Definitely will spark a debate between those on all sides of the advertising ecosystem.

I don't agree with everything he says ... in fact, for some companies, at certain stages in their evolution, brand advertising matters a great deal. However, his call for accountability, traceability and precision in media spend, and in particular the need for trackable ROI, is compelling.

Excerpt below and the full video from the original re/code article.

“Do you hate TV ads? Gabe Leydon does, too.

Except, unlike you, Gabe Leydon buys lots of TV ads: He runs Machine Zone, the game company behind all of those Mobile Strike ads with Arnold Schwarzenegger you’ve been seeing for the past few months. And the Kate Upton Game of War ads you saw last year, too.

Leydon buys those ads because he says he has to buy those ads. But he thinks they are terribly inefficient, as is almost all brand advertising: The stuff that Google, Facebook and everyone else on the Web would very much like to move online.

That’s a terrible idea, Leydon told the crowd at Code/Media last week, because almost all brand advertising is nothing more than a slush fund that feeds lazy advertisers, publishers and networks, who want to avoid accountability.

Real advertising, he argues, is the kind he buys for his games on mobile platforms like Facebook, which provide instant, precise accountability for the dollars he spends.

When Leydon laid this out for the Code/Media attendees, he freaked out most of the room — presumably because he was telling most of the room that they needed to get new jobs, stat.

It’s also possible that Leydon’s argument isn’t as strong as he thinks it is, since many advertisers want to sell things that can’t be purchased via your phone the way mobile games are. And that figuring out how to sell that stuff is always going to involve science and art, as MediaLink COO Wenda Harris Millard argued at the end of Leydon’s session.”

Sunday Sessions: Experimental Reggae

Sat down this weekend to work on a new track, and in fact, a completely new genre for me.

Despite having been born in Jamaica, I have never tried my hand at Reggae, although I have always been a fan.

This track, built with the help of the Black Arc Expansion pack from Native Instruments, blends some Reggae, Dub, Cuban and Calypso inspired themes. Still a work in progress.

Passing Time On Planes

I fly somewhere between 340-400K KMS each year, and that (obviously) implies spending hours on planes.

Although I tend to work one way, often catching up on the deluge of eMails that piles up in my inbox, I try to take some time and recharge on the way back.

In my case, this involves writing music. For me, it's not only a great way to stimulate a completely different part of my brain, there is something about the process of creation that is all consuming and makes time pass very quickly.

I carry a very smart little keyboard from CME called the xKEY. It is low profile, fits in any knapsack or shoulder bag alongside a laptop, and yet is velocity sensitive, complete with after touch. In fact, all you need is an xKey, a Laptop, and your favourite DAW, and you have a fully functional recording studio at 40,000 feet.

On the flight back from London yesterday, I spent some time on a new piece of music, enjoying and leveraging some fantastic instruments from Edwardo Tarilonte in addition to a new vocal instrument from Output, called Exhale. I would recommend you checking both of them out. I have barely scratched the surface of these libraries, and they are unreal.

So for what it's worth, here is the track that kept me occupied on the 7.5 hour flight across the atlantic yesterday, as did the unbelievable "alien" clouds (as you can see in the picture below). Caveat: the piece is still very much a work in progress.

Goldman CIO - Software is Eating Finance

Once you get past the opening preamble, this turns into an Interesting interview with Marty Chavez, the CIO of Goldman Sachs on a wide range of subjects.

Latest Remix Project: Carmina Burana

As a challenge, perhaps jokingly, a friend suggested that I try a remix of Carmina Burana.

This is a wonderful piece of music, but not a trivial one to work with as (a) it changes key, and (b) it often changes tempo ... not to mention having a wide range of moods and tonality.

Here is the first draft (and very much still a work in progress) of three of the movements. The main elements of Carmina were extracted using Native Instruments Traktor, with additional voices from the Komplete library played in on an AKAI MPK225 and a Native Instruments Komplete S62.

Update On The Four Horsemen

A must see presentation from Scott Galloway of NYU Stern, on the Four Horsemen of the internet (Apple, Google, Amazon and Facebook), who is winning and who is losing, and why Apple may very well be the first trillion dollar company.

Fasten your seatbelt, it's an action packed few minutes.