This is an incredibly difficult post to write … but read on … there is a significant opportunity here for someone to unlock.

On Friday, I had to say goodbye to one of the strongest teams I have ever had the pleasure of working with.

First, the backstory …

A few weeks ago, our Nuula Series A fell through at the last minute due to a set of unforeseen circumstances.

This round had taken months to prepare, as it represented the final step in the transformation of a 20-year-old company, with a capital stack dominated by 10+ year-old investments, and complicated by $35MM of sub debt.

A couple of years ago, we started this transformation by raising $10MM from our internal investors, converting $10MM of legacy sub debt to equity and putting in place a new loan book facility of $100MM.

With constructive input from all parties around the table, we had a framework in place to complete this journey, clean up the capital stack, and prepare the company for a true Series A launch. The Series A round was the lynchpin of that transformation, and when it fell apart, it was nearly impossible to recover in the short time we had.

With no other choice, the board decided that we should initiate the process of selling the Nuula assets. Furthermore, we had limited cash on hand, and when it became clear that we could not unlock adequate bridge financing to support operating the company for more than a few weeks, we arrived at the difficult decision to release the team at the end of September.

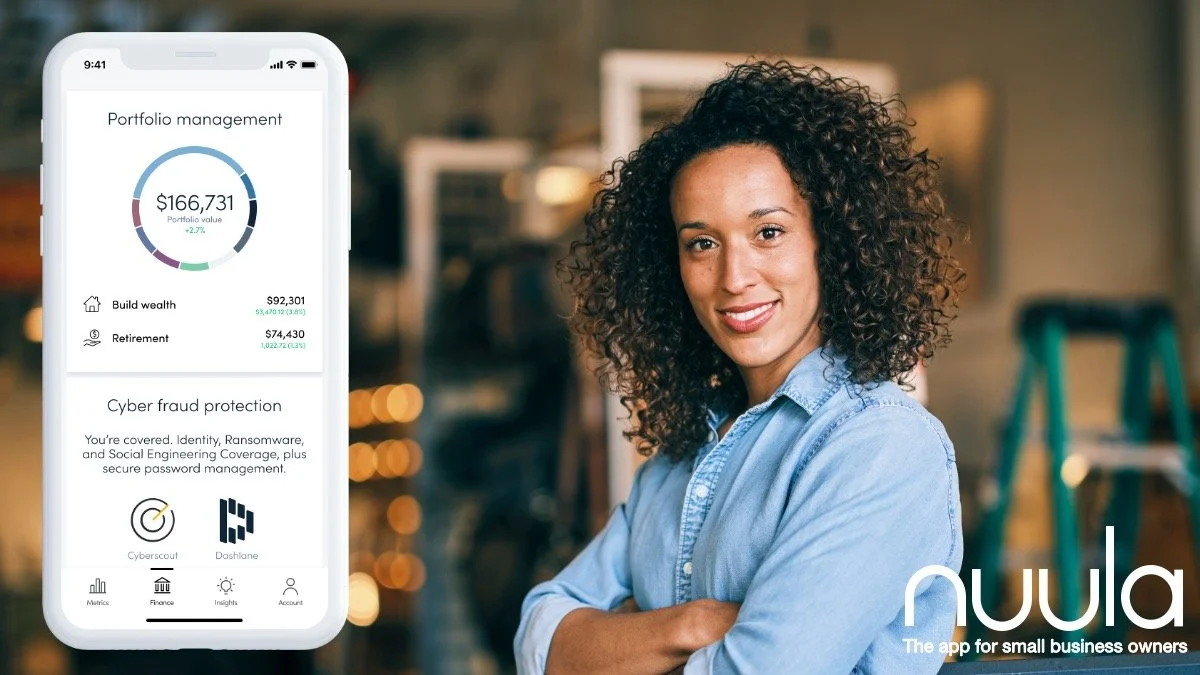

As the world's first SuperApp for small business, Nuula represents a tremendous potential asset for a buyer. It is built on a world class mobile technology platform, possesses an elegant user experience that customers love, boasts existing links to banking, cloud accounting, eCommerce and payments data, and has a robust financial services partner ecosystem already established. Because Nuula makes it possible to embed and leverage fintech offerings, region by region, it is geared to operate anywhere in the world.

Before I close, I want to thank the amazing group of people who came together to build Nuula. Not only the last team standing as of Friday, who worked tirelessly to safe the assets despite knowing they would be losing their jobs, but so many others who had been part of the journey over the past few years. You are truly exceptional, and it was a pleasure working with you.

I want to thank our partners for helping to bring Nuula to life and imbue it with such great financial products. OneVest. Walnut Insurance. Mulligan Funding, LLC. Merchant Growth. Even Financial. Huckleberry. Caary Capital. You were a pleasure to work with, and I will encourage any buyer of Nuula to rapidly reach out to you and reengage.

To the Nuula management team Patricia Korth-McDonnell, Parham Mofidi, Alex Nelsas, Peter Ng, Siddharth Kakkar, and Brian Simmons, and to every Nuuligan from Coral Springs to Toronto, you should be incredibly proud of what you have created; not only the product you brought to life, but also the company, the culture, and the powerful team spirit that you helped build. Thanks to you, we broke new ground in so many areas, and I will take these lessons with me wherever I go. I would work with any of you again, and any company would be lucky to have you.

One of our team members was gracious enough to share his thoughts with me on Friday via email in his last act before leaving, and I have shared this with our leadership team because it reflected their efforts.

“I’ve never worked at a place which had such a big emphasis on culture, where there is such transparency, trust, and alignment at all levels of the organization.

It was a really inspiring journey and has by far been the best experience I've ever had working. I just want to let you know, that despite all that has transpired, I firmly believe in the vision we formed.

When I leave here, wherever I go, wherever I end up, I know it works and have the confidence to push for what is right because I’ve seen first-hand that a company that operates like this is possible.

Thank you for everything you’ve done. I have my own challenges ahead, but I have no hard feelings.”

I believe that it is a privilege to lead, not a right. So, I am going to print this out, and stick it up on the wall in front of my desk, and hold myself accountable to meeting these standards wherever I go and whatever I do.

I firmly believe in what we have built and know that it could be a significant transformational cornerstone for the right buyer.

Please reach out via LinkedIn DM or at my Nuula or Personal emails if you are interested in learning more.