Today we are launching a fantastic partnership with the team at OneVest to deliver wealth management for Canadian entrepreneurs right inside the Nuula app.

Small business owners typically focus everything on their businesses, and often the wealth of their families is inextricably tied to the success of those businesses. Complicating this is that they are often solely responsible for their own wealth management. From retirement, to investing, to planning for major life events, most small business owners do not have the benefit of employer programs. In fact, according to Forbes, one third of small business owners do not have a retirement savings plan at all.

Nuula is launching a new wealth management feature to give small business owners a way to help diversify their wealth, and plan for the critical milestones in their lives like retirement, buying a home, or expanding their family.

Powered by the OneVest platform, our customers will now be able to invest like the 1%, unlocking access to a fully digital, actively managed, goals-based investment experience, personalized just to them. With this feature, Nuula now provides entrepreneurs with the tools to help grow their net worth both inside and outside their business, enabling them to fund one or more investment accounts, set goals, and track their progress. The solution is fully integrated within the app, so our customers can manage their business and their investments in one place.

It’s been a pleasure working with Amar Ahluwalia and the team at OneVest over the past few months, as we have integrated the capability of this fantastic platform into Nuula. The product will initially be available in Canada, with expansion to the US market expected later in the year.

Personal wealth management for entrepreneurs, in the palms of their hands. What’s not to love.

As always, stay tuned … lots more to come.

#investing #wealthmanagement #smallbusiness #entrepreneurship#nuularising

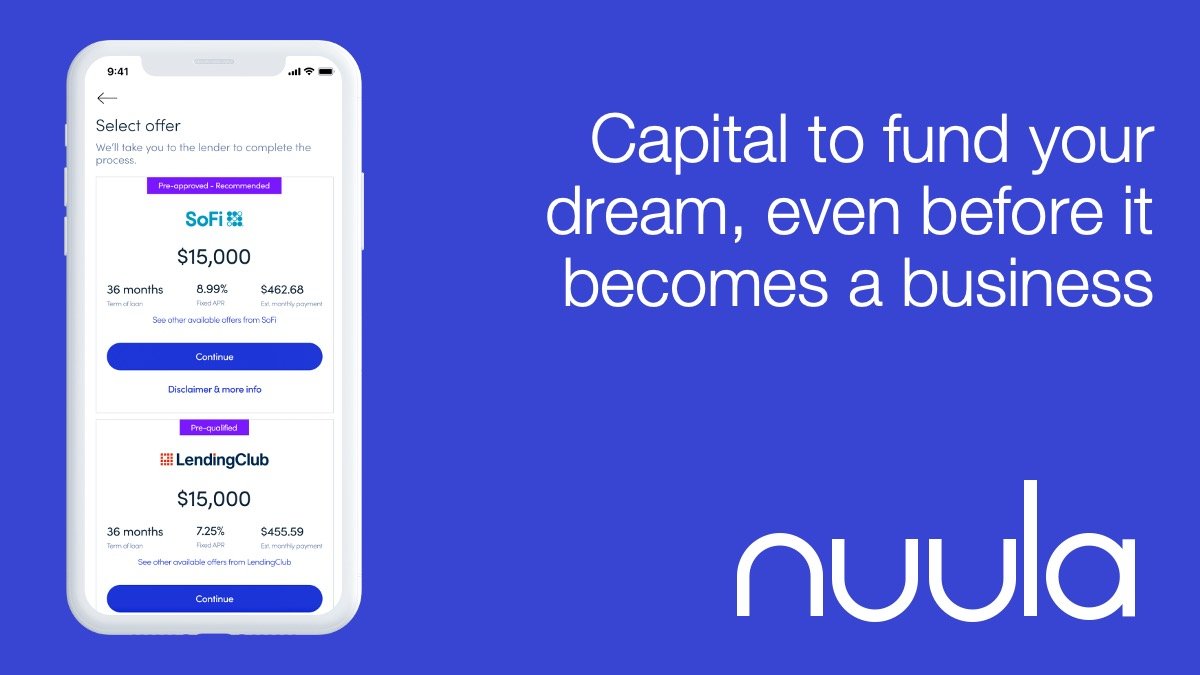

Nuula launches funding for early stage businesses

One of the hardest things for a small business is getting early stage capital. Most lenders, and I know this first hand, won’t even look at you until you have been in business over a year, but more likely two.

So, how do you raise money for a new business in its early stages? Typically with personal loans, or cash from fiends and family.

At Nuula, we felt we needed to help solve this problem, so we have partnered with Even Financial to enable our customers to unlock access to loans from over 30 lenders. Right from within the app.

Now, you’ll be able to fund that idea, even in the early stages, often same day.

Just another way we are working to help entrepreneurs realize their dreams.

Stay tuned … as always … lots more to come.

#entrepreneurs #smallbusiness #funding #nuularising

Addressing the challenges of latency in space based networks with blockchain technology

We are still at the early days of identifying all the use cases around blockchain technologies, but an announcement from Davos this week caught my eye.

Lockheed Martin and the Filecoin Foundation have collaborated to demonstrate a blockchain network in space that helps address the latency issues that would typically be found in Earth-Space networks.

Joe Landon, vice president of advanced programs development at Lockheed Martin Space, said the goal of the project is to develop a mission to demonstrate the Interplanetary File System, or IPFS, in space.

IPFS is an open-source network that stores information that can be shared by users. The Filecoin Foundation is an independent organization that facilitates governance of the Filecoin network — a blockchain-based cryptocurrency and digital payment system that builds on top of the IPFS.

Landon said critical infrastructure is needed in space for accessing and sharing data. “Filecoin is a decentralized storage network built on top of IPFS,” he said. “The Filecoin network is powered by a blockchain-based protocol, which is used to incentivize independent storage providers to contribute storage and offer competitive deals to store customer data.”

“We need to develop the technology to support a long-term presence in space without having to rely entirely on Earth-based communications and data storage,” he said.

Marta Belcher, president and chair of the Filecoin Foundation, said today’s centralized internet model “just doesn’t work in space.”

“Every time you click, that data has to be retrieved from a particular server in a particular place,” she said. “That means that if you’re on the moon, there’s going to be a multi second delay while that data travels from Earth, but with IPFS data isn’t retrieved by where it is, but rather by what it is, so it can be retrieved from whatever’s closest to you, eliminating that delay.”

Over the next several months, Lockheed Martin and Filecoin will work to identify a spacecraft platform to host an IPFS payload that will relay data to and from Earth,and other spacecraft.

“We are starting out with an exploration phase that will include scoping the technical work required and identifying the right demonstration mission,” said Belcher. “Once we have identified the appropriate mission or missions, we’ll have a longer-term timeline.”

The initial payload demonstration is being planned for low Earth orbit.

IPFS allows users to back up files and websites by hosting them across numerous nodes. Landon said this project aims to bring the benefits of decentralized storage systems to space. “Ultimately, by minimizing the number of times that data has to be transmitted to Earth and return to space, IPFS’s decentralized storage model will enable more efficient data transfer and communication in space,” he said.

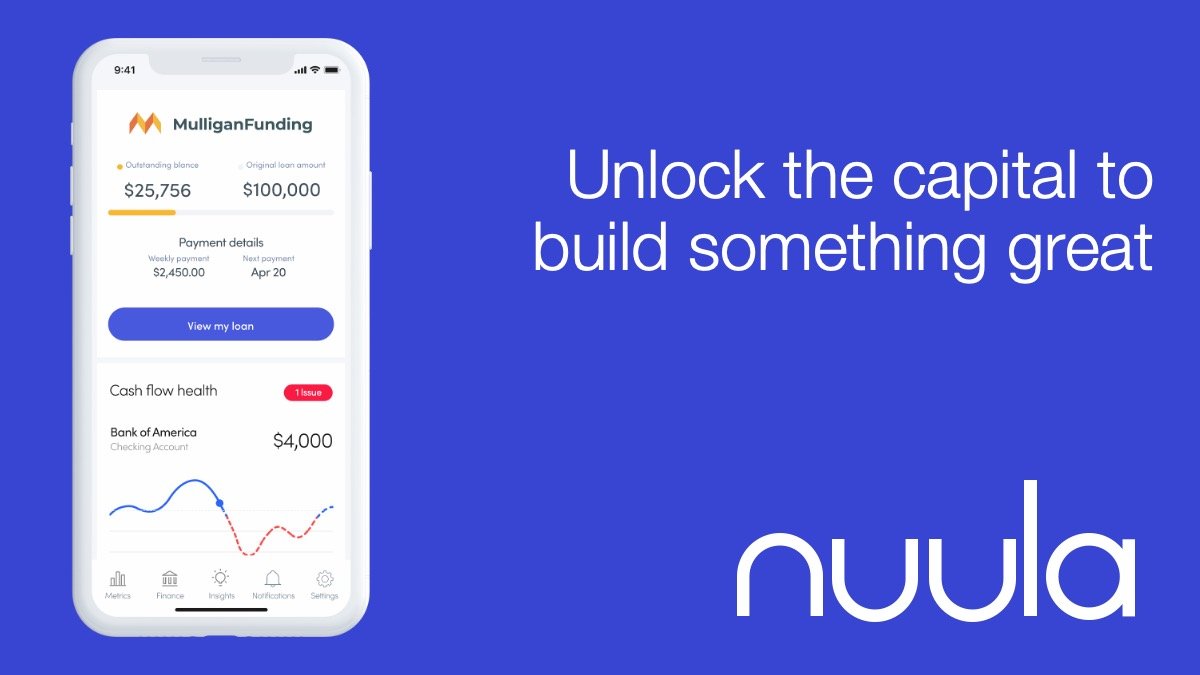

Nuula makes small business loans of up to $2MM available in the palm of your hand

As I have been signalling, there would be more to come from Nuula as we roll out a suite of integrated financial products that serve both the needs of small businesses and the entrepreneurs who run them.

Easier this week, we announced a partnership with Walnut Insurance to provide a wellness package for entrepreneurs.

Today I am thrilled to let you know that we have partnered with Mulligan Funding, LLC to integrate their term loan product deeply into our app, and in so doing, help entrepreneurs power their vision.

Starting today, Nuula customers will be able to apply for up to $2MM in business funding directly from the app. They will also be able to monitor and manage their loan 24/7/365 right from within Nuula.

Capital is the lifeblood of small businesses, and it’s always been at the heart of our mission at Nuula.

It’s been a pleasure getting to know David Leibowitz and the team at Mulligan over the past couple of years, and I’m excited to launch this product with them.

Access to up to $2MM in capital from the palm of your hands ... what's not to love.

As always, stay tuned … there’s lots more to come!

#smallbusiness #fintech #capital #smallbusinessfunding #funding #nuularising

Understanding how profound web3 actually is ...

Despite all of the hype and hysteria surrounding Crypto, Blockchain technology and DeFi, Web3 is both in its infancy, and here to stay.

a16z has been an early and aggressive investor in this space, and their views on this emerging ecosystem are always worth reading. Their 2022 State of Crypto Report is a helpful primer and a timely and pragmatic update on the sector.

As with all early technologies, there will be winners and losers, fortunes made and lost, legacy industries disrupted or transformed … and there will certainly be a lot of entropy … but few technologies have come along in a very long time that have this sort of disruptive potential. Ignore this space at your peril.

Serving the needs of both the Business and the Entrepreneur

For a small business owner or entrepreneur, work and life are inextricably linked.

I know this first hand, having launched two early stage startups, and having led fast growing companies of various sizes for over 20 years.

I am therefore thrilled to let you know that starting today, Nuula is launching a new approach to small business financial services by focusing not only on the needs of the business, but also on the needs of the small business owner.

In partnership with Walnut Insurance, Nuula’s new health and wellness feature offers access to meditation, sleep guides, and mental focus programs through Headspace Plus in addition to online fitness programs through ClassPassDigital. The programs are paired with $10k-$50k of Life Insurance to help give small business owners additional peace of mind. All of this is available for as little as $9/month, and can be activated in less than 2 minutes right from within the Nuula App.

The new offering complements Nuula’s existing portfolio of free small business tools, including financial & sales performance tracking, cash-flow forecasting, personal and business credit monitoring, and the ability to stay on top of customer ratings and reviews … all delivered 7/24/365 in a simple, easy to digest format, right to the palms of your hands.

Nuula’s focus on the entrepreneur’s well-being, in addition to business performance, was driven by insights into how personal stress is affecting small business owners, especially with the pressures of the COVID-19 pandemic.

A recent Capital One survey found that 45% of small business owners report that running a business during the pandemic has had a negative impact on their mental well-being, and 42% say they are currently experiencing burnout or have experienced it within the past month.

It’s just another way we’re thinking differently about serving the needs of small businesses, and the entrepreneurs who power them.

Stay tuned … lots more is coming!

#health #businessowners #fintechinnovation #wellness #smallbusiness

Our notion of "the office" will likely never be the same

There has been a lot of discussion recently about how "return to the office" should be handled. Some companies are "back", some are mandating 2-3 days a week in the office, others have re-configured to be primarily remote, perhaps in perpetuity.

At Nuula, we have been thinking deeply about this, particularly in the context of what the best answer should be for our company and for all of our stakeholders.

As a technology and data science company based in Toronto, we are in a war for talent. And as a venture backed business, with a ton of world beating ambition, we're also driven to run farther and faster than our peers. All of this is built on hiring the best and the brightest, and finding the most opportune way for them to leverage their skills and each other.

As a CEO, I believe in building cohesive, dynamic, ambitious teams that are comfortable challenging pre-conceived notions. But that means, as a leader, I must also challenge my own pre-conceptions.

Historically, I have always enjoyed face-face interaction. And those who know me, know that I have always led by "walking around" ... even when my teams were spread across the world (yes, I have the air miles to prove it). But, something fundamental has shifted over the past few years, and it is worth understanding.

A combination of COVID, technology and time has challenged the pre-conceived notion that effective collaboration requires that we work together face-face, primarily in open plan offices, and that we do so most of the time. In fact, for many people, the relief of not having to commute an hour or more each day, and not sit in sometimes chaotic and noisy open plan environments, has changed their expectations of both productivity and work-life balance (or as a Type A myself, what I like to think of as work-life integration). Once we worked through the kinks, many of us actually saw increases in both productivity and employee satisfaction as we adopted to hybrid work.

As leaders we ignore this cultural shift at our peril ... and at the peril of our businesses.

At Nuula, we work hard to remain in touch with the sentiment, needs and wants of our Team members, polling them regularly on a number of issues on which we want their feedback. We recently updated our "return to office" sentiment index, and the results were fascinating.

Our most recent poll (see above) has indicated a fundamental shift in sentiment away from the office as our default mode of operation. Our team does not seem to be pining for the "good old days" of in office interaction, nor do they want us to impose some sort of arbitrary 1-2 day per week rotating office use. They want to live and work more on their terms.

60% of them are happy coming in for intentional "collaboration" or having the office as a place to work when they want to or need to ... but a surprising 40% are now seeking a more fundamental shift to a primary WFH mode ... in particular if that affords them the ability to live where they want.

We engage in this communication with our teammates, because we are striving to ensue that Nuula is the place where the best and the brightest want to come to work. We hold ourselves accountable quantitatively by tracking a satisfaction/sentiment index and an eNPS score, but we also seek qualitative feedback on a regular basis to try and understand what we can do better.

We are going to be taking this feedback seriously, and working even harder to lean into providing the flexibility sought by our teammates, re-imagining our concept of what it means to work at Nuula, how we work together better regardless of where we are, and the fundamental meaning of what our office is, and how we use it.

I'll try to update you on our progress ...

Work/Life Integration and the 4-day Work Week

We recently started to experiment at Nuula with an optional 4-day work week.

We started by asking ourselves ... what if people didn't have to commute an hour a day ... how could we re-purpose that time to start with, and what might they be able to accomplish ... we also figured that a zoom/pandemic fatigue was a real issue, and we wanted to give people recharge time.

We hoped that when people know they had less time for work, they would become more intentional. They might also happier. They might also be more creative.

We realized that we needed to be deliberate and thoughtful about this as an organization ... we needed to force ourselves to reduce the typical overhead that seeps into traditional weeks. Cut the fat of unnecessary meetings …

The test started with our Technology team, and as is typical with all things Nuula, we set up a way to review outcomes in a disciplined way, through a blend of qualitative and quantitative lenses.

At this stage, about 80% of our Tech team takes advantage of the program, and while we're not yet ready to make a permanent decision one way or the other, initial feedback (qualitative) and productivity scores (quantitative) are both very encouraging so far. A sneak preview on the quant side is that our story point output is as good, if not better across 4 days as opposed to 5.

I'll update you more on our learnings over the next few weeks, but I think this option is going to be here to stay. We are certainly seeing happier and more productive team members.

In the mean time, the following article outlines some issues/considerations/approaches. Worth a read.

This was a nice surprise

We were happy to find out this week that #Nuula was selected as a finalist for the Small & Medium Business Sized Lender of the Year and that I’d also been selected as a finalist for the Executive of the Year as part of the 2022 Leaders in Lending Awards presented by BMO Financial Group.

Thanks to the Canadian Lenders Association for the nominations and congratulations to all of the finalists!

Disruptive Innovation

A friend of mine who is a former Goldman exec, recently articulated something I too have been feeling for some time; namely that we are at a particularly exiting period of disruptive innovation … with implications both sectoral, and cross-sectoral.

Accelerating advances in Genomics, Energy (both generation and storage), Blockchain (and decentralized finance - or DEFI), Web3 (and the Metaverse), Robotics/Autonomous driving, 3D printing, AI, etc. are creating an opportunity for seismic shifts in healthcare, supply chains, transportation, finance, entertainment, etc.

As with all periods of disruptive innovation, there will be winners and losers, in both new and legacy industries. And with any early stage of disruptive innovation it won’t exactly be clear who the winners and losers will be.

Ignore this at your peril though … there are fundamental implications for many companies and many industries … and if you are a business eater (in any business) you need to understand them.

Although it has recently become the family of funds that people seem to poking fun at (due to a temporal downfall in value as investors have shifted to “risk off” assets), I have a huge amount of respect for the mission, vision and approach taken by the team at ARK Invest. I will leave it up to you to make your own investing decisions, but one thing I would recommend is that you look at their research, it’s both accessible and informative.

Each year, they publish a Big Ideas presentation. It’s available in PDF from their website, but below is their annual Big Ideas Summit. It’s a thorough look into a range of emerging technologies and their inherent disruptive potential.

Who knows how much of this will come to light, and in what way. And who knows which individual investments will be winners and which will be losers. But, if you are not conversant in some of the these areas, I suggest you become so.

January Progress Update

This month, the challenge for the marketing team was to continue the account registration momentum with a 33% reduction in marketing spend Month on Month. Thrilled to say, not only did they do it, but registration for the line of credit waitlist soared.

This month was all about improvements in targeting … the CPI remained relatively constant, but the conversion rate rose, and as a result CAC fell.

Next up … moving deeper into the retention/engagement and monetization stack …now that we have the data we can start to identify and target customers with the highest propensity to activate tools and/or successfully apply for one of our credit products.

Telling the Story of Nuula

Thrilled to show off the work our team has done on a 60 second spot for Nuula. Particularly remarkable that it is all stock video and was extremely inexpensive to produce.

Employee Wellbeing

We are human powered businesses.

As leaders, we are constantly asking ourselves if we are creating a workplace that the best and the brightest would want to work for, and fostering an environment in which they can thrive.

At Nuula, we work hard to have a clear and exciting mission and to offer challenging and stimulating roles for our teammates. We try to hire well and train well. We provide opportunities for growth. We celebrate diversity. We’re accountable to each other, and we’re open, honest and transparent.

These are table stakes …

We also understand that we hire whole humans … with different sets of dreams, fears, obligations, strengths, weaknesses … and in trying to foster an environment in which our team members can thrive, we need to take this into account. We try hard to look at the more holistic needs of our teammates … and in doing so, we acknowledge that they have lives outside of work.

One of the key elements of this strategy (and there are others) is that we provide structured and unstructured time off in which to rest, recharge, and inspire creativity. And while we work incredibly hard, we strive to make it easier for our employees to have a healthy work-life balance. We’re proud to offer our employees the flexibility to take care of themselves and their families.

This stuff matters. A lot.

About 4-5 times a year, we give the team the day to explore their creative side, to learn to discover, to mentally refresh … and we then encourage them to share what they have done. We call these Nuula You Days …

Here’s a video we put together to get our team motivated for our upcoming You Day.

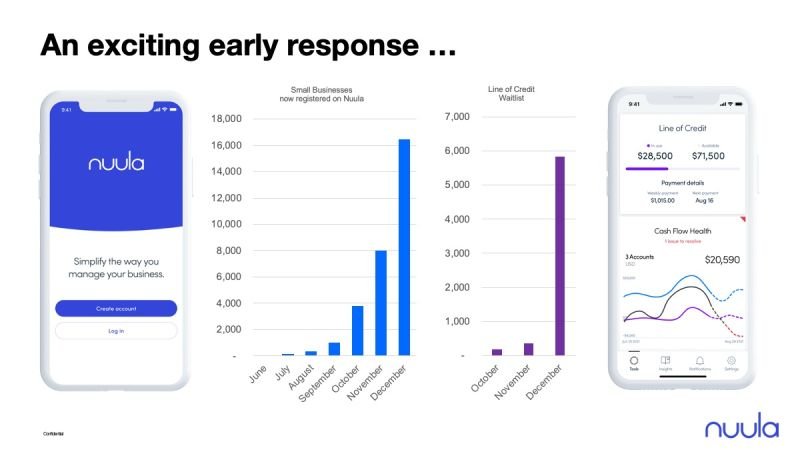

December Milestone

As I was making last month's post about the progress we had seen with Nuula, I couldn't help but wonder if we would be able to keep up the rapid rate of (exponential) growth.

Well, we did ... by the end of December, the number of small businesses who had registered on Nuula had grown to over 16,000 and the Line of Credit waitlist had grown to just under 6,000. Encouragingly, CAC had fallen to below $30.

I think our thesis is playing out ... clearly a new generation of small business owners is hungry for a new generation of financial services.

In the coming weeks, complementing our "cash in the cloud" line of credit, we will be announcing larger longer term loans, a modern digital credit card, and a suite of insurance offerings ... all brought to the platform by a carefully curated ecosystem of partners.

50,000 Download Milestone

Nuula just passed 50,000 downloads on Google Play ... less than 6 months in after our quiet test and learn start ... not a bad way to end a week!

November Progress

It's so encouraging to see the excitement that Nuula is generating amongst US small businesses.

Once again, we have doubled lifetime registrations month on month. Furthermore, the wait list for our new "cash in the cloud" line of credit has started to surge in the few weeks that it has been open. Yes, the chart is way out of date as of this morning ... the waitlist will hit 500 today, and November 30th was only three days ago.

Nuula's Financial Health Tool

So excited to be launching Nuula's Financial Health tool this morning.

Most small business owners want to keep up-to-date on the overall health of their business daily, but rarely have the time to do this. By coupling a small business's accounting data with Nuula's existing business tools and insights, including cash flow tracking, personal & business credit monitoring, in addition to customer reviews and ratings, we've made that even easier. Anytime and anywhere. In the palm of their hand.

Thanks to the team at Codat for helping to power this new tool, and to the amazing tech team at Nuula for such an elegant solution.

So much more to come ... stay tuned ...

October MILESTONE

As a CEO, it's always encouraging to see customer demand soar for your product, in particular when that demand is evidenced by exponential growth in registrations. For Nuula, October saw 3.7X more small businesses registered on the platform than all prior months combined. Capping 4 successive months of accelerating growth.

To complement the Cashflow Forecasting, Credit Monitoring and Customer Sentiment tracking that we already offer small business owners to help them stay on top of what matters, our revolutionary "Cash in the Cloud" line of credit has now launched into private beta. If you want to get on the waitlist, please let me know.

Stay tuned ...

Exciting News: Today Nuula Was Born

I joined BFS Capital two and a half years ago because I saw an opportunity for significant innovation in small business financial services.

After seven years working in online consumer finance, managing businesses across North America, Europe, South Africa, and South America, I had first-hand experience bringing industry-leading fintech solutions to market. When I looked at what was happening worldwide in consumer finance, compared to the types of legacy, laggard experiences small business owners were still wrestling with, it was clear that there was a significant innovation gap. On top of this, a new generation of small business owners was emerging, demanding the anytime, anywhere, on their terms, mobile first experiences they were now accustomed to in the rest of their digital lives. It was clear we were reaching an inevitable point of inflection in small business financial services.

The investors behind BFS agreed, and together we committed to transforming a company that had deep roots in small business lending, and a deep understanding small businesses in its DNA, into one that was equipped to lead innovation in small business financial services. Our approach was to start by leveraging our two decades of data and experience, from tens of thousands of customers across 400 industries. Based on these unique insights, we would build a fintech startup that would provide small businesses with innovative financial solutions that not only met their emerging digital expectations, but helped them drive great business outcomes.

We quickly assembled a leadership team whose experience spanned global financial services, innovative challenger banks, mobile app design, creative and brand development, customer experience innovation, and digital transformation. But most importantly, we sought a team capable of rapidly developing and executing an ambitious strategy to emerge as a leader in small business financial services.

We spent time with the next generation of small business owners understanding their pain points, their motivations, and their passions. We sought inspiration, worldwide, from the best mobile and digital experiences we could find. We crafted a vision for a company that provided not only innovative financial solutions, but employed a more holistic approach, delivering content, tools, and financial products, purpose-built to serve small business owners’ daily critical needs.

Our next job was transforming a two-decade old “mechanical turk” of business into a lean, digital, mobile first fintech – all in the middle of a pandemic. We made the tough decision to significantly reduce our legacy team, and immediately set about acquiring the skillsets we would need to realize our vision.

We established a digital headquarters in Toronto, and focused on hiring world-class talent in data, machine learning, technology, and digital marketing. We transformed internal workflows completely, in order to support a remote and distributed workforce across the US, UK, Canada, and South America. Most importantly, we shifted our philosophy from solely selling loans acquired primarily from brokers, to providing a more holistic, customer-centric mobile app that entrepreneurs would find useful each and every day. This app-centric model would not only radically improve our customer acquisition, engagement, retention, and monetization efforts (thereby reducing acquisition costs and increasing customer lifetime value) but it would be the foundation for us to deliver a significant increase in enterprise value.

The reimagined future of BFS starts now, and today I’m proud to announce that BFS Capital has become Nuula. This brand change represents the manifestation of the shared vision and effort from our entire global team across the past 18 months.

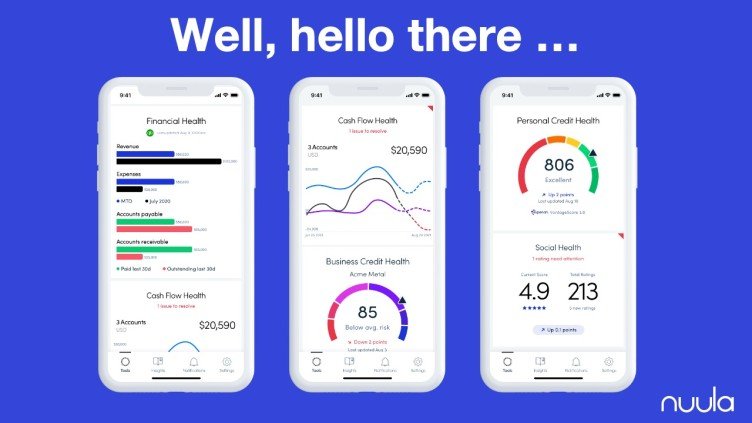

Nuula is a mobile application that gives small business owners instant access to critical business metrics anytime, anywhere. It allows real-time monitoring of cash flow, personal and business credit activity, and social ratings and reviews. Small business owners know immediately if there’s an issue with their cash, credit, or reputation that requires action.

But this is just the beginning. Our goal is to empower small business owners by unlocking access to the smartest and most innovative financial solutions available. Some delivered by our team, others delivered by a carefully curated set of partners. All delivered to the palms of their hands, anytime, anywhere, within a seamless user experience.

So stay tuned. In the coming weeks and months, we will launch a suite of next generation financial products, including a revolutionary line of credit that will enable small businesses to access the capital they need to thrive.

With regards to our legacy business, our team will continue to support our existing customers and partners as we transition all our services to Nuula. Our existing customers will be the first to be offered a chance to experience Nuula. And over the next few weeks, our existing working capital customers will be able to unlock additional capital from the first of our Nuula ecosystem partners, with exciting incentives and in a way that is as seamless as possible. We expect to make that announcement soon.

I want to thank all of the team, our board, and investors, in addition to our partners and customers who have gone on this journey so far. And we look forward to breaking new ground together with Nuula. For small businesses, we believe this changes everything.

Mark Ruddock

CEO, Nuula

Keynote at Data Analytics & the Future of Lending

Here are some rough insights on the fast growing role of data science in the future of small business lending.