Small business owners typically devote all their time and effort on their businesses. It’s an all encompassing passion. It’s also often where the entirety of their family’s wealth resides.

It’s important for these entrepreneurs to be able to diversify their wealth, and proactively manage wealth creation outside their businesses. Especially now when risks are high across the board. But opportunities also abound.

However, these time constrained individuals are often solely responsible for their own wealth management. From retirement, to investing, to planning for major life events, most small business owners do not have the benefit of employer programs or third party investment managers. In fact, according to Forbes, one third of small business owners do not have a retirement savings plan at all.

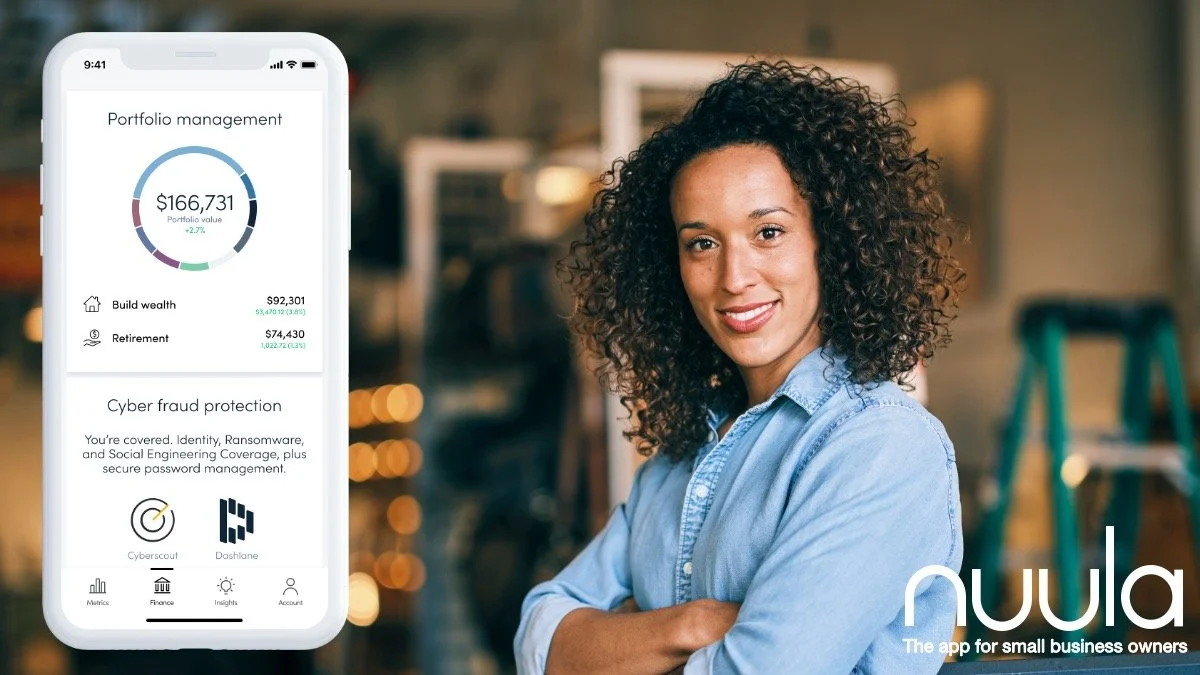

Nuula’s integrated wealth management feature (built on the terrific OneVest platform) is designed to help small business owners diversify and build wealth, helping them save for personal milestones in their lives like retirement, buying a home, or expanding their family. They can do this by accessing to a fully digital, actively managed, goals-based investment experience, personalized just to them.

This feature is available to our Canadian customers today, but will be launched in the US later this year.

Integrated Wealth Management. Just another way Nuula serves the particular needs of small business owners.

What’s not to love.

#wealthmanagement #smallbusiness #entrepreneur #fintech #planning#investment #businessowners #superapp

Mark Ruddock

Thoughts of an internationally experienced growth stage CEO and Board Member

Mark Ruddock

Personal blog of an international FinTech executive.

I'm an experienced international CEO with two successful exits and over 20 years of experience at the helm of VC backed technology and fintech startups.

I've both founded companies, and come in as a later stage CEO to help existing companies scale. My experience spans multi-country online financial services, mission critical enterprise software and consumer-focused mobile applications.

I've recently returned to the supervisory board of 4finance, after completing a year as interim CEO. At 4finance, we are leveraging deep technology and data science to build a mobile-first, customer focused business that delivers compelling financial products and services to those underserved by traditional financial institutions. Today, we are Europe’s largest online consumer lender, with over $500MM in revenue and 3,500 employees serving customers across 17 countries. The company is a proven and trusted alternative to conventional bank lending. With half the world's adult population still financially underserved, the potential is significant.

Previously I was Chairman of Finstar Labs. Our mission at Finstar Labs is to identify, invest in and help create the cutting edge user experiences, enabling technologies, and data science that will lay the foundation for the next generation of alternative financial services.

Prior to that I was Managing Director, International at Wonga, responsible for overseeing all businesses outside of the UK, including consumer lending businesses in Canada, Spain, Poland and South Africa and our eCommerce and product financing business BillPay in Germany.

Prior to that I was the CEO of Viigo, which became one of the most highly downloaded Blackberry apps of all time before being acquired by RIM (Blackberry) in 2010.

Before that I was the founder & CEO of INEA, an enterprise software company focused on the financial services industry, which was acquired by Cartesis in 2005, and is now part of SAP.

AFINEA | 136 Arundel Ave, Toronto